What Happens to Your Payment Plan if You Owe the Irs Again This Year

| | Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

TAX PENALTIES

What to do if you default on an IRS Payment Plan

IRS data shows that almost 1/3rd of IRS payment plans default each year. That amounts to over 1 million taxpayers a year who get into hot water because their IRS payment plan has been terminated for noncompliance.

For those who default on an IRS payment plan or "installment agreement," there are a few options to get back in good standing with the IRS and avoid enforced collection activity (liens and levies).

What causes default?

There are four reasons the IRS defaults installment agreements and requires the taxpayer to make a new agreement or pay the tax to avoid enforced collection:

- You missed payment(s) (for IRS streamlined installment agreement payment plans; the IRS allows you to miss one a year without default)

- You file another return and fail to pay the tax liability at the time the liability is due or owe a balance from another return(such as from an audit or CP2000 assessment) and do not pay the balance in full (including penalties and interest)

- The IRS asks you to provide updated financial information and you do not provide the information or provide inaccurate or incomplete information

- You fail to pay a modified payment amount that you agreed to with the IRS

Two important items

First, the IRS does not allow more than one collection arrangement per taxpayer. For example, if you are in an installment agreement for a year and you file and owe on the next year, the IRS will not give you a separate payment plan on the new return balance you owe. You can only have one agreement with the IRS and it must cover all balances owed.

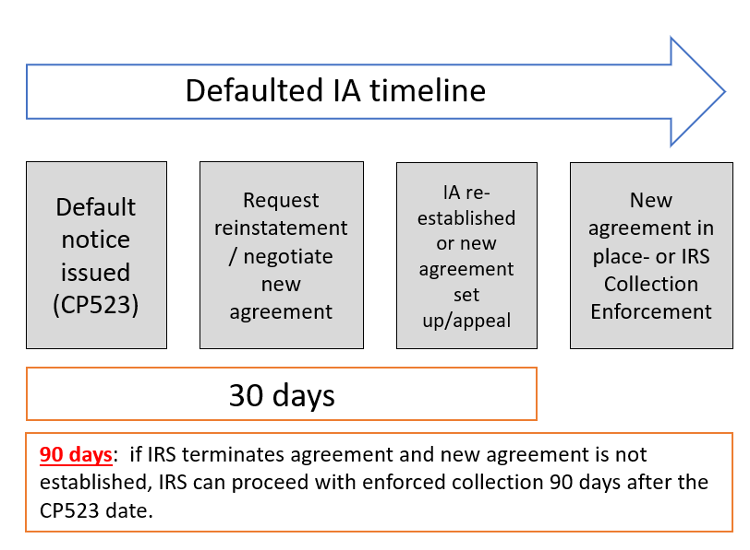

Default timeline and reinstatement

When you miss a payment, file another balance due return without payment, or fail to comply with the terms of the payment plan, the IRS ultimately sends you one of two notices: CP523 or Letter 2975. These notices do not terminate your agreement. Instead, they put you on notice that you have 30 days to take action or the agreement will be terminated. The IRS will not issue a levy until 90 days after the CP523/Letter 2975 date.

Within the next 30 days after the CP523 notice, you can reinstate the installment agreement to avoid IRS levies. However, the IRS has the discretion to request new financial information depending on your circumstances to reinstate the agreement. Routinely, the IRS allows two circumstances to automatically reinstate the payment plan:

- The agreement defaulted because of a new tax liability and the new amount would be paid in two additional monthly payments, or

- The taxpayer would qualify for a streamlined installment agreement(owe less than $50,000 and can pay within 72 months) AND the taxpayer has not defaulted on an installment agreement in the past 12 months.

In both circumstances, the IRS reserves the right to file a federal tax lien. However, in practice, the IRS rarely files a lien (assuming one is not already filed) if the taxpayer owes under $10,000 or qualifies and obtains a streamlined installment agreement.

Starting from scratch

If you cannot satisfy the automatic criteria for reinstatement, the IRS will want financial information. In some cases, you may be able to provide limited financial information over the phone (usually employer and bank information) if you can pay on the streamlined installment agreement terms. But if you cannot pay the streamlined terms or owe over $50,000, the IRS will want more detailed financial information. Taxpayers who owe over $50,000 will likely have a federal tax lien filed and will need to obtain a payment plan based on their ability to pay.

If the taxpayer defaulted because of a new balance due from a recently filed return, the IRS will want the taxpayer to increase their withholding and/or make estimated tax payments if under-withholding was the cause for the new balance.

The cost of doing nothing

If a taxpayer does not get back into good standing with the IRS within 90 days, they may face enforced IRS collection. If a lien has not been filed, the taxpayer is likely to see a tax lien filing if they owe more than $10,000 . The IRS will also look to employers, financial institutions, and other payers for payment in the form of a levy. If you owe more than $54,000, the IRS may start passport restriction proceedings with the State Department.

In many cases, it is practical to get into a streamlined installment agreement. If you can reassure the IRS that you will not owe again and agree to direct debit payments, it may allow you to reinstate your agreement provided a reinstatement fee of $89 is paid.

For assistance creating a strategy to address your tax issue, visit Jackson Hewitt's Tax Resolution Hub to see the various ways we can help you.

![]()

About the Author

Jim Buttonow, CPA, CITP, is the Senior Vice President for Post-Filing Tax Services at Jackson Hewitt. He's been a leader in helping taxpayers and tax professionals resolve tax problems with the IRS, where he had worked for 19 years in various compliance-enforcement positions. Prior to his current role, Jim's consulting practice focused on the areas of tax controversy and tax administration, which included leading product development on tax problem software for tax professionals, testifying before Congress, advocating for IRS transparency and efficiency, and proposing innovative large-scale solutions for taxpayers and tax professionals. Jim is also the author of Tax Problems and Solutions Handbook, a publication aimed at helping tax pros work more effectively in post-filing matters and resolving their clients' most common tax problems.

View Jim's LinkedIn Profile

Jackson Hewitt Editorial Policy

Owe back taxes? Jackson Hewitt® can help.

![]()

Why Jackson Hewitt®?

We see you

Our Tax Pros will connect with you one-on-one, answer all your questions, and always go the extra mile to support you.

We got you

We have flexible hours, locations, and filing options that cater to every hardworking tax filer.

GUARANTEED

We've seen it all and will help you through it all. 35 years of experience and our guarantees back it up.

Source: https://www.jacksonhewitt.com/tax-help/tax-tips-topics/penalties/what-to-do-if-you-default-on-an-irs-payment-plan/

0 Response to "What Happens to Your Payment Plan if You Owe the Irs Again This Year"

Post a Comment